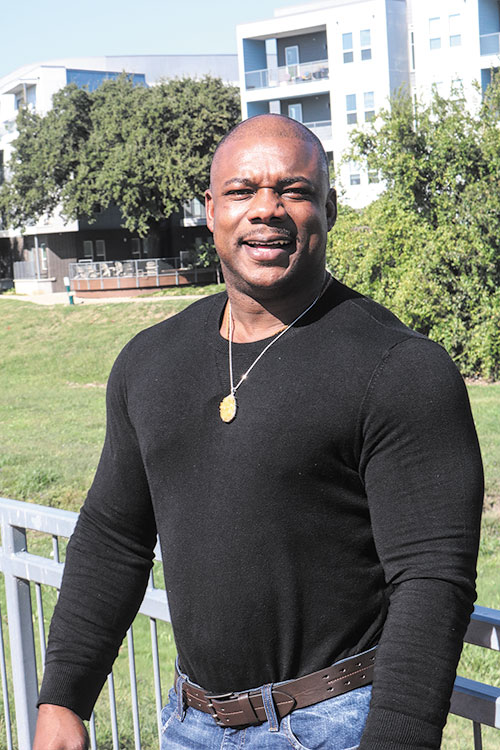

Laforenzo Wilkins (David Taffet/Dallas Voice)

Laforenzo Wilkins started a company that specializes in credit repair

DAVID TAFFET | Senior Staff Writer

taffet@dallasvoice.com

Laforenzo Wilkins kept himself busy during the pandemic: He came out. He started a new business. And he helped a number of people along the way.

Wilkins grew up in poverty in a small town in Mississippi, where “I had no one to teach me about financial literacy,” he said. So he joined the military and was stationed in South Korea.

After his discharge, he earned his BA and began a career as a car salesman. But, he said, “I always knew I wanted to help people, to teach people.”

So, he said, he spent time praying and asking himself, “What am I supposed to be doing?”

He found the AM/PM Academy of Credit Repair online and took a course from a woman with a background similar to his. Then in 2020, he took a job with Amazon and opened his credit repair business in October. He was doing so well that by March of this year he quit his job at Amazon to devote his full time and attention to his rapidly growing E3 Financial Solutions.

What Wilkins does is not just help fix credit reports; he also teaches his clients to improve their credit scores.

What Wilkins does is not just help fix credit reports; he also teaches his clients to improve their credit scores.

Take buying a car, for example. Wilkins suggests getting approved for credit before you begin shopping.

When you walk into a dealer, the first thing they offer is car financing, and they want to pull your credit report. That dings your credit score a few points. Visit half a dozen dealers and you’re dinged multiple times.

Instead, he suggests, go to a bank and arrange financing. See how much car you qualify for before going to a dealership. Wilkins said he’s already helped more than 30 families buy vehicles by cleaning up their credit reports.

Another tip, Wilkins said, is knowing that “a clean credit report is as important as your score.”

He said, “I’ve helped seven or eight people buy their dream home,” explaining that those people had the same income after he was done; all he did was clean up their credit report by removing items that were wrong or inconsistent between the three credit reporting agencies.

In one case, his client qualified to purchase a $700,000 house after Wilkins cleaned up the reports. He said his client, with a $300,000 income, was certainly able to afford the property. The problem was incorrect information that kept his score low.

He said there are different reasons for a bad credit report. Even higher income people might be hit with large medical bills, and anyone may be guilty of simple mismanagement of debt.

A common problem many people have is credit card debt. Making minimum payments doesn’t decrease the amount owed. Buy something and the balance increases until suddenly you’re out of credit. Then, you are missing payments or opening a new account and using that card to pay off another.

Wilkins said he said he uses credit laws to remove errors. What if there are no errors in your credit report?

“There are always things that are wrong,” he said. “I go line by line.”

Many people are plagued by student loan debt. Wilkins said he consolidates the loans to clean up the record. Often student loans are listed separately for each semester or school year you attended. While you make one payment, the report may show half a dozen loans. Consolidating them into one loan doesn’t decrease the amount owed, but looks much better in a credit report and increases your credit score.

Wilkins offers a free credit consultation. He reviews what steps you’ve been taking, goes over your credit reports and makes sure there’s been no identity theft, whether by an anonymous source or a family member.

Quite a bit of identity theft causing damage to someone’s credit, Wilkins said, is done by a family member with a similar name who has access to your social security number and other pieces of personal information.

After the initial consultation, there’s an enrollment fee and a monthly charge until his client has finished the program. Wilkins said cleaning up a credit report takes on average six months, but may sometimes take up to a year.

In addition to working with the reports, Wilkins said he’ll recommend using some credit builders. If his client doesn’t have a credit card, he’ll recommend using a secured, prepaid card then make small purchases using the card and pay off the balance.

“Credit is a tricky thing,” he said. But it’s important to have, because you never know when something is going to happen.

For more information, visit E3FinancialSolutions.com. To contact Wilkins, email hello@E3FinancialSolutions.com, visit E3FinancialSolutions on Facebook or call 877-960-1333.