Activist investment strategies can bring you a better return

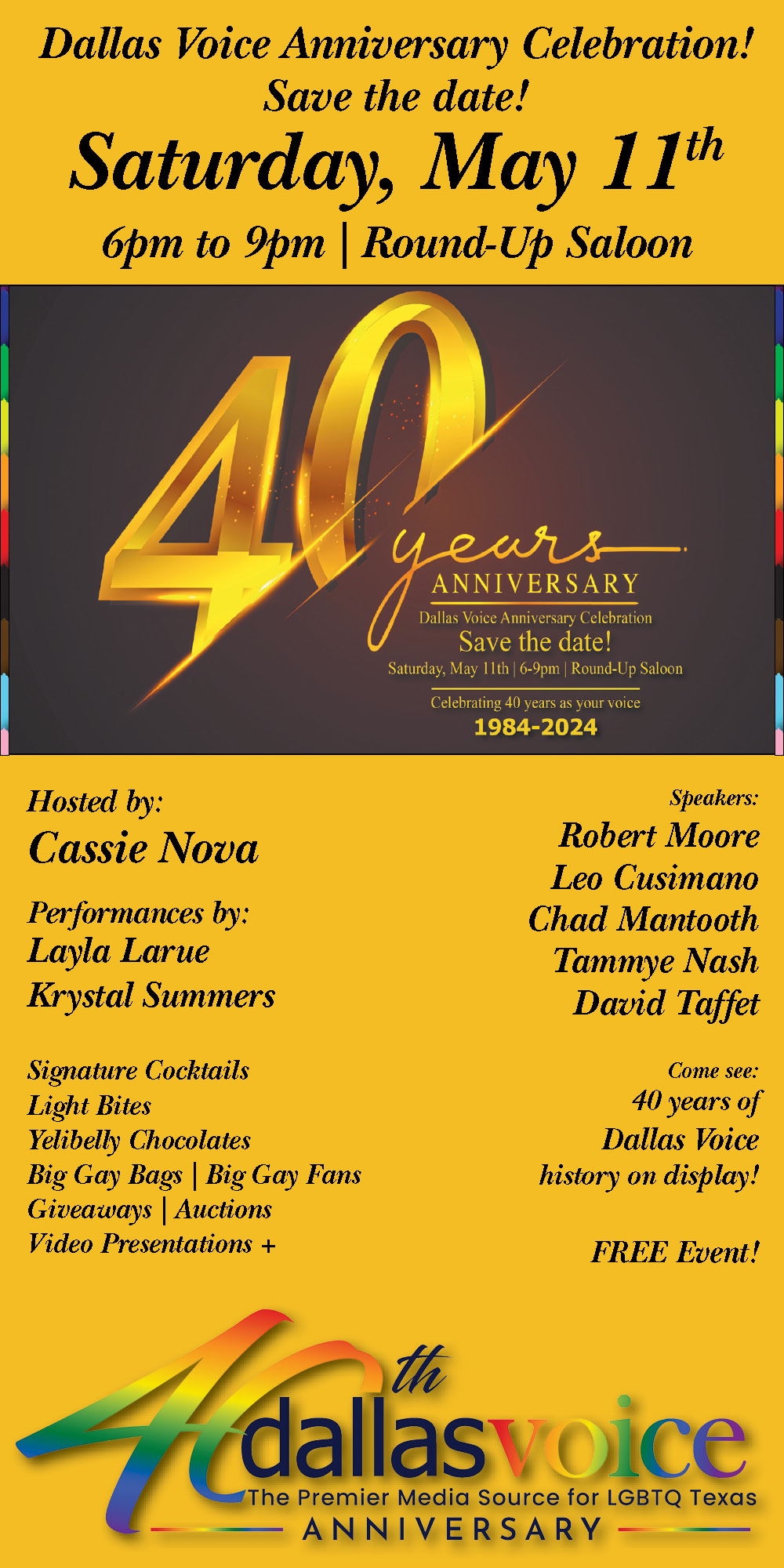

Tammye Nash | Managing Editor

If you are looking to support the LGBT community with your charitable donations, it’s not hard to find a whole slew of worthy nonprofits that could put your pink dollars to good use.

But sometimes we need to put those dollars to work making more dollars for us. In other words, sometimes we need to invest rather than donate. Is it possible to be community conscious with our investments as well as our charity.

Absolutely.

Actually, notes financial advisor Judy S. Sherman with Nexus Adviors, “socially conscious” investments strategies aren’t new at all.

“You can certainly find socially-conscious investments that allow you to exclude companies that you don’t want to put your money into for some reason,” Sherman said. “Some people hate Wal-Mart, some hate tobacco, some hate guns, some hate Exxon. So when I am planning their investments, I screen out those companies.”

Sherman suggests looking at Human Rights Campaign’s annual Corporate Equality Index if you want to put your money into companies that has LGBT-inclusive and supportive policies.

The CEI ranks companies based on a number of criteria, such as whether they have specific policies prohibiting discrimination based on sexual orientation and gender identity, whether they offer domestic partner benefits, whether they have transgender-inclusive benefits, whether they have LGBT employee resource groups and whether they have made a public commitment to the LGBT community.

The reports then scores the companies, from 100 to 0, based on those criteria. In the 2017 CEI, 517 major businesses spanning nearly every industry and geography earned a score of 100 percent. (Read the full report online at HRC.org.)

Sherman also suggested that it’s getting easier to find investment opportunities that fit a philosophy of investing in those that invest in us.

“You can usually start with the larger companies,” she said. “Mass Mutual is one of the big companies that I work with, and they have very good policies. They got a 100 percent score on the CEI. Then look at some of the big banks, like JP Morgan Chase. Most of the big banks are good options when it comes to companies that support their LGBT employees and the community.

“Really though,” she continued, “these days it seems like everyone is recognizing that it is important to embrace equality.”

Chuck Smith, CEO of the statewide advocacy organization Equality Texas, suggested another easy way to find LGTB-supportive companies in which to invest: Just look at the businesses that are urging the Texas Legislature not to go down the North Carolina road.

Early in 2016, after the Charlotte City Council approved a nondiscrimination ordinance including protections for LGBT people, the North Carolina Legislature hastily passed a bill — the notorious HB 2 — that prohibited local governments from enacting such ordinances, and then went a step further to require transgender people to use the gender-specific public bathroom facilities conforming to gender on their birth certificates rather than the facility congruent with their actual gender identity.

Then-Gov. Pat McCrory signed the bill into law on March 23 — and the blowback came fast and furious. Performers began canceling concerts in North Carolina. Companies that had been considering moving there very publicly decided not to. Other city, county and state governments around the country banned official travel to the state. Conventions and conferences were canceled or moved. The NCAA and the ACC college sports organizations moved all their scheduled championship games out of the state.

According to an article published Nov. 3 on Forbes.com, as of that date North Carolina had lost about $630 million in business over HB 2. (McCrory also lost his bid for re-election.)

Now Texas Lt. Gov. Dan Patrick is urging Lone Star State lawmakers to approve a similar bill — SB 6 — and Texas’ business community is leading the charge against that bit of discrimination. And that, Smith said, gives investors an easy way to find companies that deserve their money.

“First thing to do is look to see which companies are members of Texas Competes,” Smith said. Texas Competes is “a partnership of business leaders committed to a Texas that is economically vibrant and welcoming of all people,” including LGBT people. The complete list of members is available online at TexasCompetes.org.

Another group, Keep Texas Open for Business, is also campaigning against the Texas bathroom bill.

“These are all companies who don’t just have LGBT-inclusive policies, they have actually invested in stopping discrimination,” Smith said. “Apple Computer, for example, has been very active in this effort. And it’s important for these companies to see that their efforts are appreciated. We need people to invest in these companies and to buy their products.”

Sherman, noting that there are “hundreds of thousands” of financial advisors and investment firms, encouraged LGBT investors to work with LGBT financial advisors, “someone who is out and active in the community.

“It’s one thing to throw some money at the community to try a buy a market share, but it’s completely different to earn that market share through putting some real sweat equity into the community itself.”

While it’s obvious that LGBT investors will get personal satisfaction out of putting their investment dollars into companies that support the community, one Colorado-based investment firm has shown that doing so is likely to get you a higher “ROE” — “return on equity” — as well as a higher “ROE” — “return on equality.”

Denver Investments has created the Workplace Equality Index, and from that built the Workplace Equality Portfolio. And the company has recently issued a report — “The Shareholder Case for LGBT Workplace Equality” — that shows that companies that embrace workplace equality will, overtime, out-perform their less-inclusive competitors.

“We identified a long-term trend toward outperformance of companies relative to their respective sector peers after adopting LGBT-inclusive workplace polices,” notes the report, authored by John N. Roberts and Cristian A. Landa. “Specifically, both the percentage of companies outperforming their respective sector and the companies’ absolute outperformance of the sector increased five to 10 years after adopting LGBT-inclusive workplace policies.”

Roberts, who manages the Workplace Equality Portfolio for Denver Investments, said that the portfolio was born back in the late 1990s after Ken Mossier, founder of RSVP Vacations died, leaving his estate to the Mossier Foundation, which promotes LGBT entrepreneurs.

After Mossier died in 1996, the foundation officials “came to me and said, ‘We only want to invest in companies that have LGBT-inclusive policies,” Roberts explained. “Back then, we didn’t have Google, where we could type in a search and find out what companies that included. So we started calling these companies and asking whether they offered partner benefits.”

Back then, he said, offering domestic partner benefits was the heighth of inclusivity, and “we found 24 companies that actually offered partner benefits.”

Since then, just as with HRC’s Corporate Equality Index, the criteria have grown and changed — nondiscrimination policies based on sexual orientation and gender identity and expression, transgender health benefits, employee support and resource groups, and these days, “full parity of benefits, basically treating everyone the same, regardless,” Roberts said.

In the nearly 20 years since the Mossier Foundation set things in motion with that request, Roberts said, Denver Investments has built “a data set that is unrivaled” in terms of determining inclusivity. “We’re no longer just asking companies what their policies are, we are talking to the employees themselves, asking how well their companies are living up to their policies and promises. We are looking for companies that don’t just talk the talk; we want companies that really walk the walk.”

Over the years, and with the Return on Equality report, Roberts said that Denver Investments has found — and proven — that companies that treat their LGBT employees, all their employees, fairly perform better for their shareholders too.

“The difference is really stunning,” he said. “We’re talking about companies that outperform their competitors by about 2 percent a year, going back 20 years or so. Take that 2 percent a year and compound it by 20 years, and you are talking about a huge difference.”

Today, he said, the Workplace Equality Index includes 260 companies that all have “state of the art LGBT-inclusive policies.”

“There’s always been a lot of qualitative information on why it’s a good idea for companies to treat their LGBT employees well, but there was scant research in terms of what was in it for the companies and their shareholders,” Roberts said. “Now, we have quantified that difference. We’ve proven that you’ll do better from an investment standpoint when you go with inclusive, supportive companies.

“That’s a powerful statement.”

This article appeared in the Dallas Voice print edition February, 24, 2017.