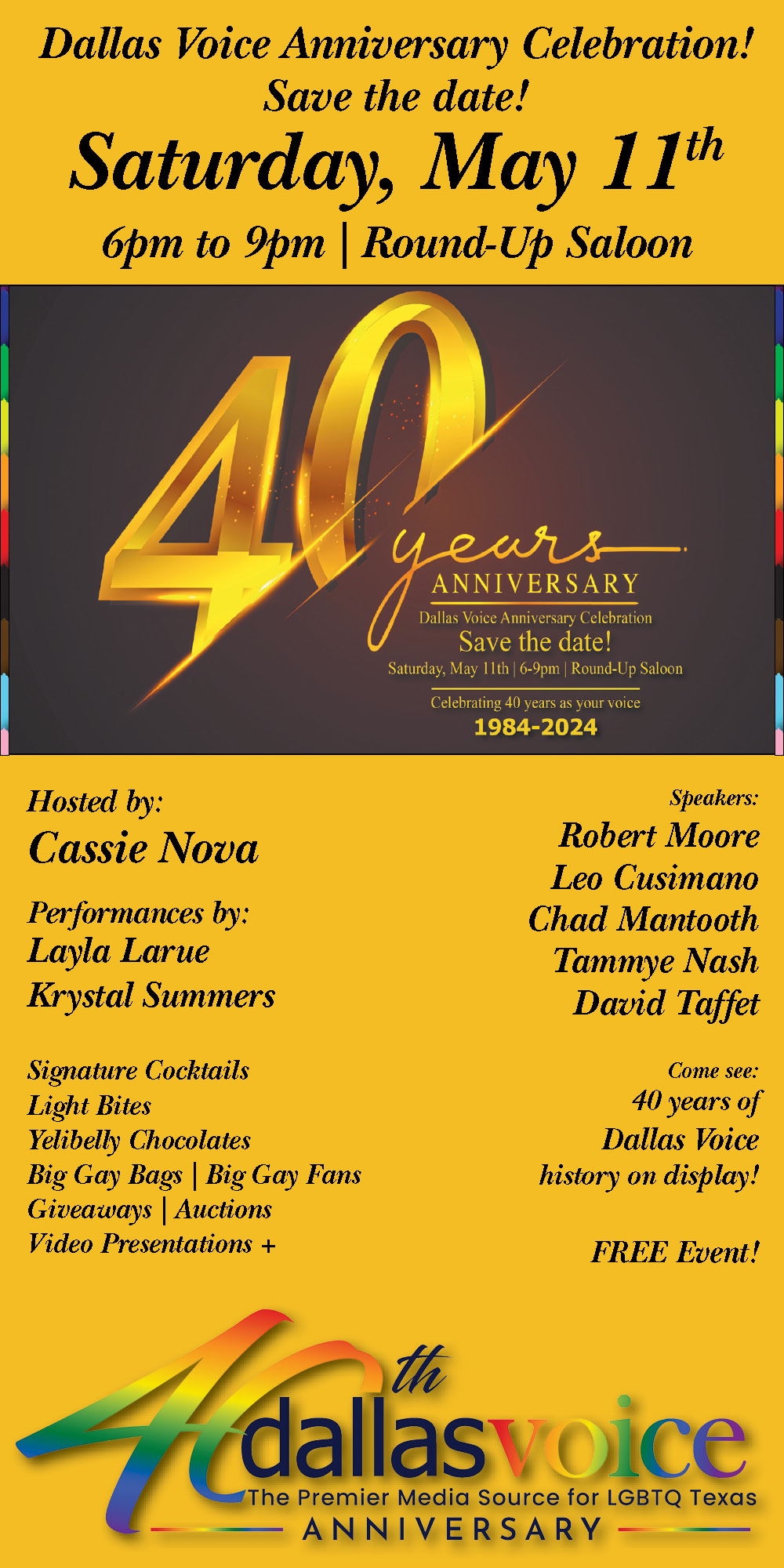

DAVID TAFFET | Senior Staff Writer

taffet@dallasvoice.com

Before advising a same-sex couple on which investments would work best for them, financial advisor Stephanie Sammons makes sure she understands the family and everyone’s roles and responsibilities, especially when kids are involved.

She draws from her own experience.

“My spouse adopted children with her ex,” she said.

Her spouse’s ex has a new partner as well. They call themselves “the four moms.” Since the situation is complicated, rather than just name a beneficiary, Sammons set up a trust for her wife.

“When my spouse passes away, she’d want me to have her assets,” she said. “But then she wants the assets to go to her children. That requires a trust.”

When she first meets with clients, Sammons discusses the family’s situation. Are they legally married?

“With marriage equality at the federal level, there are additional protections,” she said.

But with rulings like a recent Texas Supreme Court decision that said the Obergefell case only required the state to issue marriage licenses and benefits are yet to be decided, even married same-sex couples should be a little cautious.

When children are involved, Sammons has the couple define each of their roles. If the children are from a previous marriage or relationship, are both members of the couple equally responsible? Has the new spouse adopted the partner’s child?

If the couple adopted their children, are both parents on the adoption papers? If they adopted before marriage equality, only one parent was on the original adoption paperwork. The partner would have to do a second parent adoption later. A married couple may adopt together.

Once the couple Sammons is working with has written out their financial and family goals, she can begin to advise.

Are wills in place to carry out their basic wishes? If not, she advises them to see an attorney who can discuss those plans.

Next, she’ll review beneficiary designations.

“You’d be surprised how many people in our community don’t have their beneficiary designations listed,” she said.

She advises clients who are legally married to have copies of their marriage licenses on hand. In some places where a next of kin is needed, like at a hospital, some people will simply ask the question, “are you legally married?” While some people who would assume the answer is honest when talking to an opposite-sex couple are speaking to a same-sex couple, they’ll want proof.

“Once you do get married, you have more flexibility to pass assets back and forth between each other without tax consequences,” Sammons said.

One investment vehicle Sammons recommends when talking to clients with children is a 529 account.

“529 accounts are a nice way for parents to put money away for college,” Sammons explained. “Money grows tax-free and is distributed tax-free if distributed for college.”

“What we accumulated before marriage is separate,” she said. “What we accumulated together belongs to both.”

She suggested a pre-nuptial agreement for couples who’ve accumulated considerable assets before marrying but warned of the connotations that may have.

In making a financial plan, Sammons said a couple should define and document their goals together. A young couple might be saving for a surrogate to start a family. An older couple may be planning for what they’ll need to eventually retire. They should consider their immediate tax situation and how filing jointly will change what they owe.

Sammons said where a couple is in life and what they’ll need at retirement ultimately determine what she recommends they should keep in stocks, bonds or cash.

For more information on Stephanie Sammons and Sammons Wealth, visit SammonsWealth.com.

This article appeared in the Dallas Voice print edition July 28, 2017.